As an experienced tax specialist, I often get asked about the “Where’s my refund?” tool, and I can’t stress enough how important it is for taxpayers to use this resource to track the status of their tax refund. In this article, I’ll explain what the “Where’s my refund?” tool is, how to use it, and what to do if you encounter any issues.

What is the “Where’s my refund?” tool?

The “Where’s my refund?” tool is an online tool provided by the Internal Revenue Service (IRS) that allows taxpayers to check the status of their tax refund. It’s available 24 hours a day, 7 days a week, and is updated daily to provide the most current information about your refund.

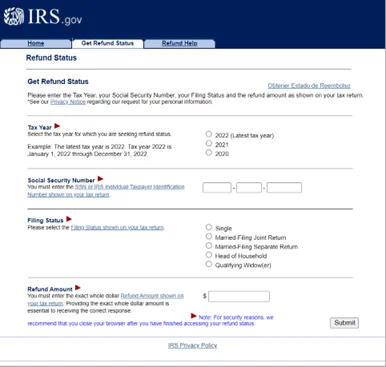

How to use the “Where’s my refund?” tool?

To use the “Where’s my refund?” tool, you’ll need to provide some basic information, including your Social Security number, your filing status, and the exact amount of your refund. This information can be found on your tax return.

Once you enter this information, the tool will provide you with the status of your refund. There are three possible status updates:

- Return Received: This means that the IRS has received your tax return and is processing it.

- Refund Approved: This means that the IRS has finished processing your tax return and has approved your refund.

- Refund Sent: This means that the IRS has sent your refund to your bank or other financial institution.

If your refund status is “Refund Approved” or “Refund Sent,” the tool will also provide an estimated date for when you can expect to receive your refund.

What are the benefits of using the “Where’s my refund?” tool?

There are several benefits to using the “Where’s my refund?” tool:

- It’s easy and convenient: You can use the tool from the comfort of your own home, and you don’t need to call or visit the IRS to get an update on your refund.

- It’s accurate: The tool is updated daily, so you can be sure that the information you’re getting is current and accurate.

- It can help you avoid scams: If you’re waiting for a tax refund, you may be vulnerable to scams. The “Where’s my refund?” tool can help you avoid these scams by providing you with accurate information about your refund.

- It can help you plan your finances: Knowing when to expect your refund can help you plan your finances more effectively. If you’re expecting a refund, you can use the estimated date provided by the tool to make financial plans.

What should I do if I encounter issues with the “Where’s my refund?” tool?

If you encounter any issues with the “Where’s my refund?” tool, there are several steps you can take:

- Wait: Sometimes, the tool may not provide an update on your refund status immediately. If this happens, wait a few days and try again.

- Check your information: Make sure that you’re entering your Social Security number, filing status, and refund amount correctly. Even a small mistake can cause the tool to give you incorrect information.

- Check for errors on your tax return: If the tool indicates that your return has not been received, there may be errors on your tax return that are causing a delay. Check your tax return carefully for any errors, and correct them as soon as possible.

- Contact the IRS: If you’ve tried the above steps and are still having issues with the tool, you can contact the IRS for assistance. You can call the IRS at 1-800-829-1040, or you can visit your local IRS office.

- Be patient: Processing tax returns and issuing refunds can take time, especially during peak filing season. If you’re expecting a refund, it’s important to be patient and wait for the IRS to process your return and issue your refund.

Tips for using the “Where’s my refund?” tool

Here are some tips for using the “Where’s my refund?” tool:

Use the tool after the IRS has received your tax return:

You can use the tool to check the status of your refund once the IRS has received your tax return. If you try to use the tool before the IRS has received your tax return, you won’t get any information about your refund status.

Check the tool regularly:

The tool is updated daily, so it’s a good idea to check it regularly to see if there have been any updates to your refund status.

Be patient:

As mentioned earlier, processing tax returns and issuing refunds can take time. It’s important to be patient and wait for the IRS to process your return and issue your refund.

Avoid scams:

Be cautious of scams that may try to trick you into providing personal information. The “Where’s my refund?” tool is a secure way to check the status of your refund, so you don’t need to provide any additional information to anyone claiming to be from the IRS.

Keep track of your refund:

Once the tool indicates that your refund has been sent, keep track of it to ensure that it arrives in your bank account or mailbox. If you’re expecting a direct deposit, make sure the bank account information you provided on your tax return is correct.

General factors that may affect your return

Additionally, it’s important to note that the “Where’s my refund?” tool is just one aspect of the IRS’s refund process. Many factors can affect the processing of your return and the issuance of your refund. Some common factors that may affect your refund include:

- Errors on your tax return: If there are errors on your tax return, it can delay the processing of your return and the issuance of your refund. Make sure to double-check all of the information on your tax return before submitting it.

- Incomplete tax returns: If your tax return is incomplete, it may not be processed by the IRS. Make sure to include all required information on your tax return.

- Fraudulent activity: If there is suspected fraudulent activity on your tax return, it may be subject to further review by the IRS. This can delay the processing of your return and the issuance of your refund.

- Identity theft: If you are a victim of identity theft, it can affect the processing of your return and the issuance of your refund. The IRS has programs in place to assist victims of identity theft and help prevent fraudulent activity.

- Back taxes or other debts owed to the government: If you owe back taxes or other debts to the government, your refund may be used to offset those debts. This can delay the processing of your return and the issuance of your refund.

If you encounter any of these issues or have questions about your refund, it’s important to contact the IRS for assistance. The IRS has a variety of resources available to help taxpayers, including phone lines, online resources, and in-person assistance at local offices.

In conclusion

The “Where’s my refund?” tool is an important resource for taxpayers to check the status of their tax refund. It’s easy to use, accurate and can help you avoid scams. However, it’s important to remember that the tool is just one aspect of the IRS’s refund process and that many factors can affect the processing of your return and the issuance of your refund. By staying informed about the refund process and contacting the IRS for assistance if needed, you can ensure that your refund is processed and issued as quickly as possible.

Learn more about IRS Form For Inheritance