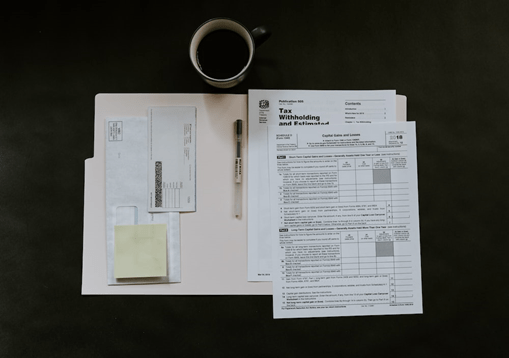

Unveiling The Benefits Of Tax-Efficient Investments

Reading Time: 8 minutes As the saying goes, “In this world, nothing can be said to be certain except death and taxes.” While we may not be able to avoid paying taxes altogether, there are smart strategies we can employ to minimize their impact on our investment returns. Tax-efficient investing is a powerful tool that allows individuals to optimize […]

Unveiling The Benefits Of Tax-Efficient Investments Read More »