Almost everyone has difficulty accurately calculating taxes. This is where tax calculators come in handy. A calculator is a software tool that helps individuals or businesses estimate their tax liability by taking into account various tax laws, deductions, and exemptions. In this article, we will discuss what a calculator is, how to work with it, and provide you with some of the best examples of tax calculation software available on the market today.

What is a Tax Calculator?

A tax calculator is an online tool that helps people estimate their tax liability. It takes into account various tax rules, such as income tax rates, deductions, exemptions, and tax credits, to determine an individual’s tax liability. By using a calculator, you can quickly determine how much tax you owe or how much refund you are entitled to.

How to Work with a Tax Calculator?

Working with a tax calculator is easy. Follow the steps below to use a calculator to estimate your taxes:

Step 1: Gather Information

Before using a tax calculator, gather all the necessary information about your income and deductions. This includes:

- Your income from all sources, including salary, wages, dividends, and interest.

- Any deductions you may be eligible for, such as charitable donations, medical expenses, and education expenses.

- Any tax credits you may be eligible for, such as child tax credit and earned income tax credit.

- Your filing status, such as single, married filing jointly, or married filing separately.

- The state where you live, as tax rates and rules vary by state.

Step 2: Choose a Tax Calculator

There are various tax calculators available online. Choose one that suits your needs and is relevant to your tax situation. Some of the best tax calculators available today include:

- TurboTax Tax Calculator: TurboTax Calculator is a popular calculator that is easy to use and provides accurate estimates. It takes into account your income, deductions, and tax credits to determine your tax liability.

- H&R Block Tax Calculator: H&R Block Tax Calculator is another popular calculator that provides accurate estimates. It takes into account various tax rules to determine your tax liability.

- IRS Withholding Calculator: The IRS Withholding Calculator is a tool provided by the IRS to help taxpayers estimate their tax liability. It takes into account your income, deductions, and tax credits to determine your tax liability.

Step 3: Enter Your Information

Once you have chosen a calculator, enter your information into the calculator. The calculator will ask you to enter your income, deductions, and tax credits. Make sure you enter the correct information to get an accurate estimate of your tax liability.

Step 4: Review the Results

After you have entered all your information, the calculator will provide you with an estimate of your tax liability. Review the results carefully to ensure that all the information is accurate. If you have any doubts, double-check your information and run the calculation again.

Step 5: File Your Taxes

Once you have estimated your tax liability, you can use the information to file your taxes. Make sure you file your taxes before the deadline to avoid penalties and interest charges.

Best Examples of Tax Calculation Software

There are many tax calculation software available on the market today. Here are some of the best examples of tax calculation software that you can use to estimate your tax liability:

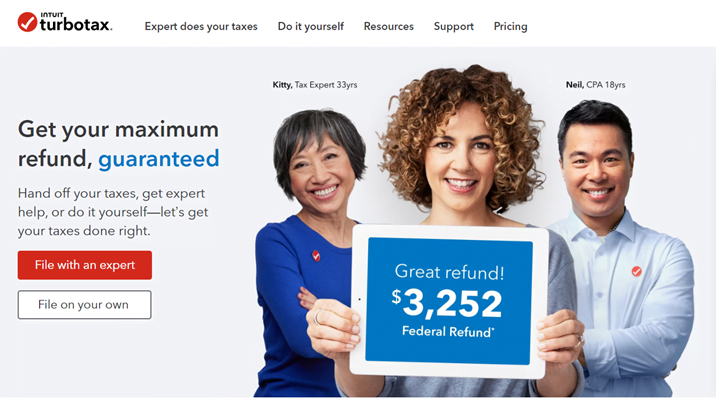

TurboTax

TurboTax is one of the most popular tax calculation software available today. It is easy to use and provides accurate estimates of your tax liability. TurboTax takes into account your income, deductions, and tax credits to determine your tax liability. It also provides step-by-step guidance on how to file your taxes, making it an ideal tool for both individuals and businesses.

H&R Block

H&R Block is another popular tax preparation and calculation software. It is known for its accuracy and user-friendly interface. H&R Block provides various tools and calculators, including a tax calculator that helps you estimate your tax liability. It also provides guidance on tax deductions and credits that you may be eligible for.

TaxAct

TaxAct is a tax preparation and filing software that provides an easy-to-use tax calculator. The calculator takes into account your income, deductions, and tax credits to estimate your tax liability accurately. TaxAct also provides guidance on tax deductions and credits that you may be eligible for, making it an ideal tool for both individuals and businesses.

IRS Tax Withholding Estimator

The IRS Tax Withholding Estimator is a tool provided by the Internal Revenue Service (IRS) that helps taxpayers estimate their tax liability. It is a free tool that takes into account your income, deductions, and tax credits to estimate your tax liability accurately. The IRS Tax Withholding Estimator also provides recommendations on how to adjust your withholding to avoid owing taxes at the end of the year.

TaxSlayer

TaxSlayer is another popular tax preparation and filing software that provides a calculator to estimate your tax liability. It takes into account your income, deductions, and tax credits to provide an accurate estimate of your tax liability. TaxSlayer also provides guidance on tax deductions and credits that you may be eligible for, making it an ideal tool for both individuals and businesses.

Consider your tax situation

A tax calculator is a useful tool to help you accurately calculate your tax liability. Using a calculator, you can quickly determine how much tax you owe or how much you are entitled to a refund. There are various tax calculators available on the internet and you should choose the one that suits your needs and suits your tax situation. Some of the best tax calculation software available today include TurboTax, H&R Block, TaxAct, IRS Tax Inhold Estimator, and TaxSlayer. With these tax calculators, you can accurately calculate your taxes and file them on time to avoid penalties and interest. But if you have any doubts, then do not be afraid to turn to tax specialists for qualified assistance. And good luck to you!

Read more about How To Prepare For US Tax Season